Market

Post-COVID Agritech Landscape in India

Summary

Agriculture has always been vital to India’s economic and social prosperity, with >50% of the population dependent on the sector for their livelihoods. Agriculture also contributes to 14-15% of the total GDP. Despite that, the sector has been plagued with problems, many of which like landholding sizes are only getting worse. Few key challenges that farmers face today include:

- Low productivity – India ranks 27th in the world in yield per acre

- Small farm holdings – India’s average landholdings of 1.1 hectares is 1/60 of farm sizes in developed countries like the US

- Access to quality cultivation support – India’s farmers don’t have access to reliable financial services, quality inputs, round the year irrigation, and mechanization support.

- Low realizations – Farmers do not receive more than 30% of the selling price for several commodities due to large number of intermediaries, inefficient supply chains and unorganized markets.

In the last few years however, there have been two major tailwinds driving the emergence of new and disruptive ways of doing business and solving these challenges

- Rising penetration of smartphones

Smartphone penetration rose in rural India from 9% in 2015 to 25% in 2018, when it recorded a 35% YoY growth. Over 30M farmers use smartphones today – unlocking easier means of communicating with them and collecting live data from the ground.

- Lower data costs

Traditionally data costs used to be high and prevented fast uptake of internet usage. But in the last 5-6 years, with the falling data costs, internet penetration has increased rapidly, especially in rural areas.

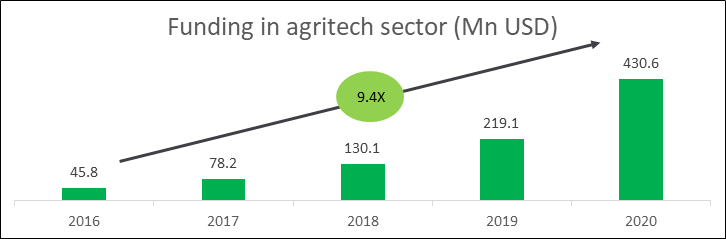

These tailwinds have disrupted a sector that has traditionally been slow to embrace technology. Coupled with India’s rising entrepreneurial ambitions, they have resulted in several agri-tech companies being founded in the last few years, resulting in agri-tech becoming one of the hottest new spaces in India’s startup ecosystem. As founders and investors begin to look beyond the first 20 million consumers, agriculture as a sector presents multiple opportunities for technology first companies to disrupt traditional modes of working. The last 5 years have witnessed a strong surge in the development of this ecosystem, with institutional funding in the sector going up by more than 9X during this period.

Impact of COVID-19

The onset of COVID-19 in early 2020 in India disrupted industries, with several SMBs and startups bearing the brunt. The restrictions imposed on logistics, the shutting down of traditional retail channels, and the sharp drop in demand, led to an unprecedented slowdown for many companies. The agri-tech sector though has proved to be surprisingly resilient. Strong tailwinds formed by restricted movement, migration of labour, and increased consumer awareness of health, have helped escalate the adoption of technology throughout the farming ecosystem. Moreover, the classification of agricultural products as essential commodities ensured business continuity for most players during the lockdown.

A survey of 67 agritech companies revealed a considerable uplift in demand for most players across the value chain during the lockdown with several of them expecting to see positive sales growth for the year

.png)

The uptick in demand translates to optimism around fundraising as well, with 60% of respondents confident about seeing increased investment activity in the sector in the next 6-12 months.

.png)

At the same time, while most companies are bullish on demand, fulfilling the increasing inbound leads has proved to be difficult for a number of companies due to various challenges, especially around logistics.

We expect the strong momentum that the agri-tech sector is witnessing to sustain in the next 12 months, as the demand for reliable food supply and quality produce increases. We believe the rapidly maturing sector and the entry of more entrepreneurs will create a fertile ground for innovative strategic plays as a direct result of the COVID-19 induced lockdown and disruptions.

.png)

Future Trends in Agri-tech

In the post-COVID era we expect to see rising adoption of various agri-tech models. In particular, we expect 4 major trends to play out in the coming year

- Rise of B2B platforms and farmer marketplaces - The rise of Flipkart and Amazon have ensured that digital marketplaces are now a mainstay for consumers in urban areas. As a natural extension to the next billion consumers who are coming online, the agri-tech sector had also begun to see the creation of such platforms much before COVID-19 with established players like Ninjacart, Agrostar and DeHaat achieving significant scale rapidly. The lack of traditional options, coupled with the absence of call-based solutions, has given a significant boost to the adoption of digital solutions among all stakeholders in the value chain. From farmers wanting to buy inputs/get agronomy advice, or retailers and agribusinesses wanting to procure output, all stakeholders in the value chain have created a sharp uptick in demand for agri-tech platforms during this period.

- Emergence of farm to consumer brands (F2C)- Increased education levels and better availability of information has resulted in a more evolved Indian consumer who has greater awareness and interest in the supply chain that lies behind the products they consume. The past few years, especially, have seen the emergence of farm-to-consumer brands (F2C), but pre-COVID-19, they were still relatively nascent and were finding limited adoption among only the internet savvy, quality seeking consumer. COVID-19, however, has led to increasing levels of health consciousness, with consumers becoming more vigilant about eating healthy and unadulterated food. This has led to a tremendous uptick in demand for F2C brands that are able to assure quality and provide traceability back to source. Moreover, with people shifting to online ordering due to the lockdown, this could prove to be a watershed moment for F2C brands as they look to disrupt traditional distribution channels.

- Precision agriculture - The pandemic led to two major disruptions in day-to-day operations int the country - Mass movement of migrant labour back to their homes, and Restricted movement of agents to farms due to the lockdown which meant that agribusinesses and BFSI institutions were left with no reliable ways of collecting on ground data. This has led to increasing adoption of precision agricultural solution to collect on ground data and remotely monitor farm conditions.

- E-markets - The last few months have created a perfect storm of events to accelerate the digitization of agri-markets. There are multiple key enablers for e-markets to gain traction in India - COVID forcing comfort with digital selling due to lack of access to physical markets, Macro policy encouraging digitized trade and transparent pricing, Standardization of quality as a key driver for multiple stakeholders, and Warehouse / logistics infrastructure that allows custodianship and specialized offerings to serve a digitized supply chain. We expect to see several startups that will look to participate in this movement and help connect farmers with buyers across the country through a digital medium.

In the report "Post COVID Agritech Landscape in India", we analyse the response of the 15 largest agri-tech players to the COVID crisis in India.

.png)

We hope these case studies serve as inspiration to aspiring agri-entrepreneurs and help them learn from some of the best companies in the business as they seek to embark on their entrepreneurial journeys.

You can download the report here:

For any queries or comments, please reach out to vedant.sharma@accel.com or saborni@omnivore.vc

Related Articles:

We’re looking for the next generation of successful Indian marketplaces. If you’re an early-stage marketplace founder, apply now here or learn more about the #DecodingMarketplaces Startup Hunt.

We’d love to hear about your experiences with marketplaces. Let us share our learnings and build a better and stronger ecosystem. Write to us at seedtoscale@accel.com to be a part of the Accel family.

Subscribe to SeedToScale

/subscribe to get the latest stories from SeedToScale/